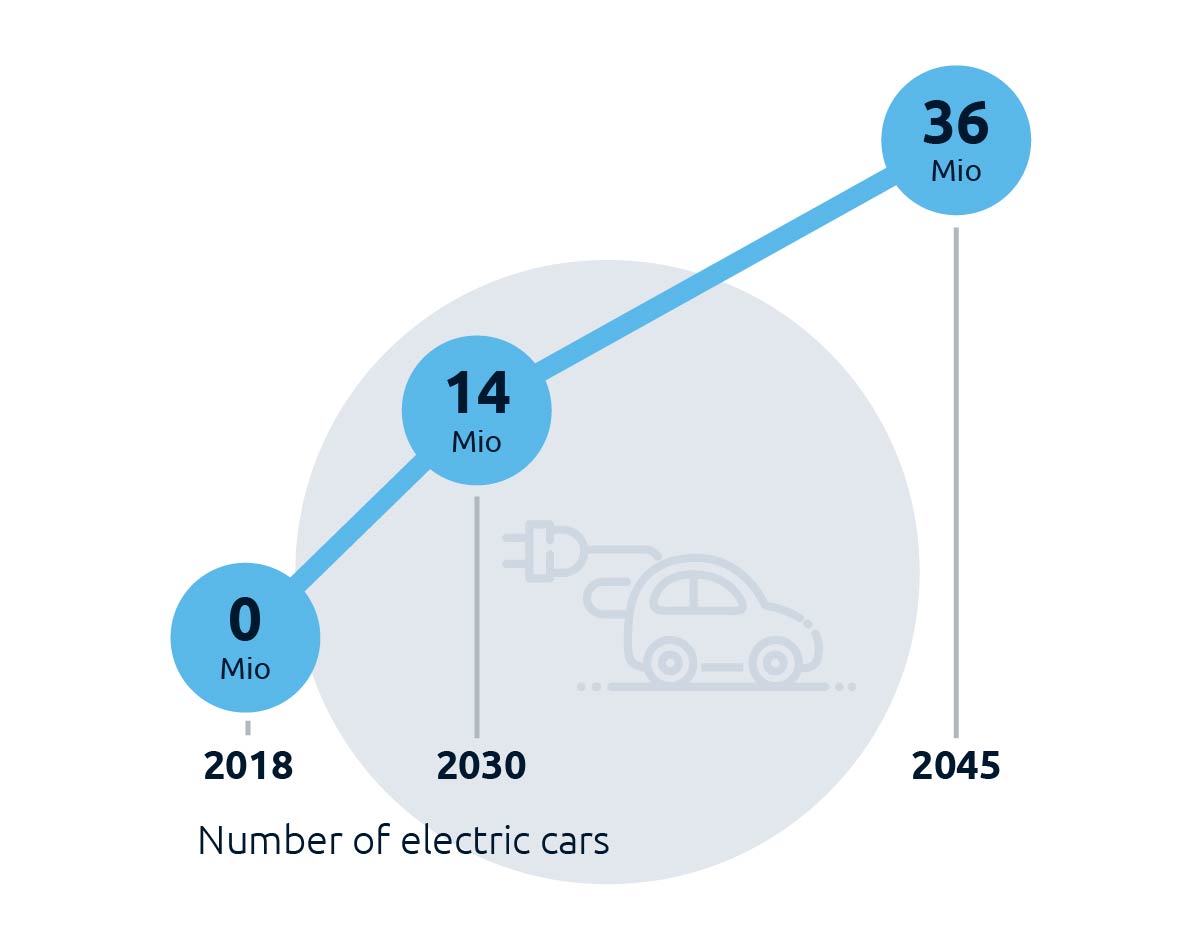

Transport is the problem child of climate policy. The study “Towards a Climate-Neutral Germany” has shown that a switch to 14 million electric vehicles by 2030 must succeed in order to achieve an interim target of 65% greenhouse gas reduction and put us on a path to climate neutrality. The current measures to promote a change of drive in road transport are not sufficient to achieve these goals.

Against this background, the Climate Neutrality Foundation is proposing a smart carbon pricing scheme for passenger cars: the annual motor vehicle tax should be redesigned so that new vehicles with CO2-emitting internal combustion engines no longer have a price advantage over zero-emission vehicles.

The proposal is based on a legal opinion (in German) by the law firm Becker Büttner Held, which examines possible national instruments that could be used to accelerate the switch to electromobility. The expert opinion concludes that, among other things, a bonus-malus system consisting of tax concessions on the one hand and higher vehicle taxation on the other would be permissible under both EU law and constitutional law.

Climate Neutrality Foundation proposes to restructure the annual motor vehicle tax for new vehicles only as follows:

In the future, the CO2 emissions alone will be decisive for the amount of the annual tax rate. A distinction will be made between three vehicle categories:

Purely battery-electric vehicles with emissions of 0 g CO2/km will remain exempt from vehicle tax. The current time limit of the tax exemption to 31.12.2030 will be lifted. Gasoline and diesel vehicles will be taxed according to their CO2 emissions (in grams per kilometer according to the manufacturer) in such a way that, calculated over a 10-year period, the average price differences to battery-electric vehicles will be compensated. Plug-in hybrid vehicles are taxed at a higher rate per gram of CO2 emission per kilometer to address the disparity that real-world fuel consumptions are usually significantly higher than indicated in the vehicle label.

What are the advantages of this proposal?

- Carbon pricing via the annual vehicle tax for new vehicles creates cost parity for the purchase of electric vehicles and internal combustion vehicles.

- Vehicle owners who made their purchase decision in the past are not affected.

- Purchase decisions for company cars are particularly stimulated, since the employer bears the vehicle tax.

- The federal budget is not burdened but relieved.

Climate Neutrality Foundation (2021):

Smart Carbon Pricing for Cars

Regulatory Proposal

Berlin, March 2021